Deductible Meals Schedule C 2024

If you are searching about How to Deduct Meals and Entertainment in 2022 | Bench Accounting you’ve visit to the right web. We have 15 Pictures about How to Deduct Meals and Entertainment in 2022 | Bench Accounting like How to Deduct Meals and Entertainment in 2022 | Bench Accounting, How to deduct the cost of travel, meals and entertainment – The Garage and also Are Client Meals Deductible?. Here it is:

How To Deduct Meals And Entertainment In 2022 | Bench Accounting

Photo Credit by: bench.co deduct

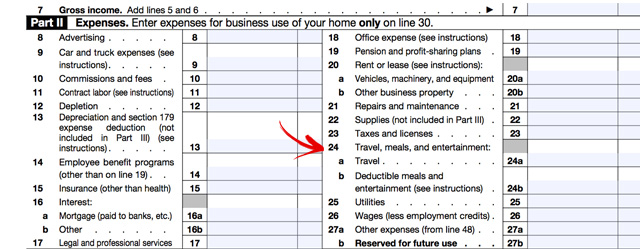

How To Deduct The Cost Of Travel, Meals And Entertainment – The Garage

Photo Credit by: www.godaddy.com expenses other meals entertainment travel schedule cost deduct garage total line costs qualify

When Are Meals 100% Deductible? – Business Accounting & Tax Services

Photo Credit by: wayfindercpa.com deductible

Meals Expenses Tax Deductibility (50% Vs. 100%) – WFY

Photo Credit by: www.cpa-wfy.com meals meal wfy

100% Deductible Meals, What Does That Mean For You? – CD Pro

Photo Credit by: cdprofessionalservices.com meals deductible deduct

Are Travel Meals 100 Deductible

Photo Credit by: scasadesigns.blogspot.com deductible imagevars gulfnews

Business Meals Fully Deductible In 2021 And 2022

Photo Credit by: www.barneswendling.com

Is Life Insurance Deductible On Schedule C : Step By Step Instructions

Photo Credit by: voleyball-games.blogspot.com expenses meals deducting deductible dontmesswithtaxes withdraw instructions

Are Client Meals Deductible?

Photo Credit by: www.akinsaccounting.com deductible

Are Meals And Entertainment Deductible In 2018?

Photo Credit by: blog.accountingprose.com deductible

Types Of Tax-Deductible Meals And Entertainment

Photo Credit by: www.irvinebookkeeping.com deductible qualified expenses deduction

New IRS Notice 2021-25: Some Business Meal Expenses Are 100% Tax

Photo Credit by: tehcpa.net irs deductible expenses pikwizard minnesota restaurants deduction

Deductible Meals | Robergtaxsolutions.com

Photo Credit by: robergtaxsolutions.com coffee deductible starbucks expense business meals meeting tag

How Can A Business Meal Be 100% Deductible? | Fairfield, CT Patch

Photo Credit by: patch.com deductible meal business vegetables answer eat only if

SCHEDULE C – Office Expense, Supplies, Travel, Deductible Meals // Tax

Photo Credit by: www.youtube.com

Deductible Meals Schedule C 2024: Schedule c. Expenses meals deducting deductible dontmesswithtaxes withdraw instructions. Is life insurance deductible on schedule c : step by step instructions. Irs deductible expenses pikwizard minnesota restaurants deduction. How to deduct the cost of travel, meals and entertainment. When are meals 100% deductible?